Get 40% off 3 Months or a Free Trial meli stock

Introduction to MELI Stock

MercadoLibre (NASDAQ: MELI) is a powerhouse in Latin America’s digital economy, leading the region in e-commerce and fintech innovation. Often compared to Amazon due to its dominance in online retail, MercadoLibre also stands out with its robust financial services platform, Mercado Pago, and a seamless logistics network, Mercado Envios.

Founded in 1999, MercadoLibre has grown exponentially by catering to the unique needs of Latin American markets. Its ability to adapt to regional challenges such as limited banking access and logistical hurdles has solidified its position as a market leader. Today, the company operates in major countries like Brazil, Argentina, and Mexico, all of which play crucial roles in its growth strategy.

For investors, MELI stock represents a compelling opportunity to gain exposure to Latin America’s expanding digital economy. The company’s diversified business model, strong market presence, and continuous innovation make it a top choice for those seeking growth-oriented investments. However, understanding its performance, competitive landscape, and potential risks is essential before investing.

This post explores the key factors driving the success of MELI stock, offering a comprehensive analysis to help you make informed investment decisions.

Market Performance Analysis

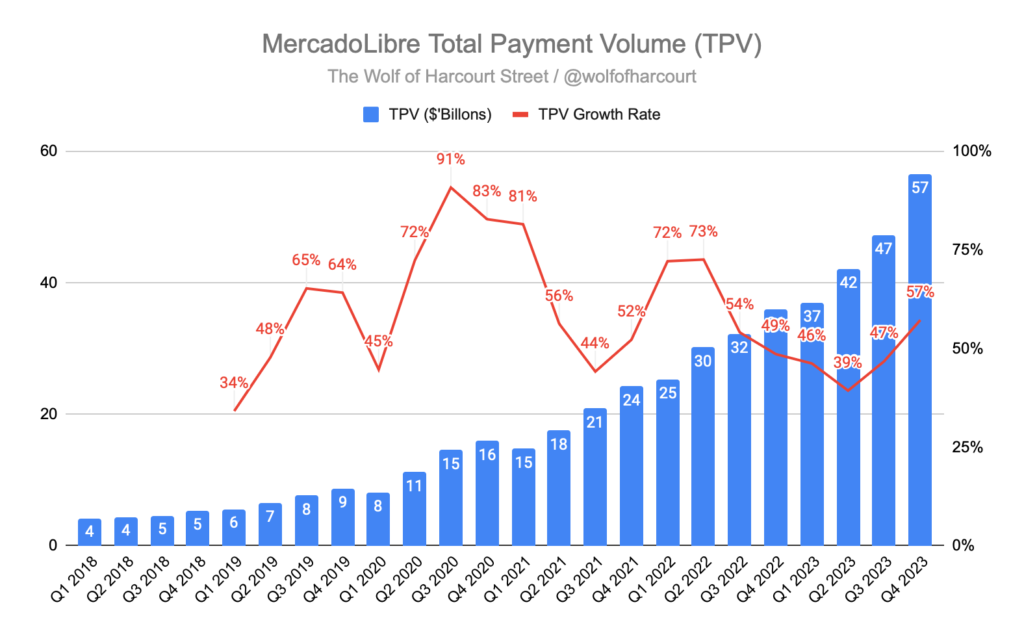

MercadoLibre (MELI) stock has become a standout in the e-commerce and fintech sectors, especially within Latin America. Investors closely monitor its performance as the company continues to capitalize on growing digital adoption in the region. In this section, we will analyze the historical performance, recent trends, and overall market position of MELI stock.

Historical Performance of MELI Stock

Since its IPO in 2007, MELI stock has shown remarkable growth. Starting as a regional e-commerce company, MercadoLibre has transformed into a multi-faceted platform offering marketplace services, digital payments, and fintech solutions. Over the years, its stock price has reflected this evolution, delivering significant returns for long-term investors. For instance, the company has consistently outperformed broader market indices, proving its resilience in a competitive industry.

.

Recent Trends

In recent years, MELI stock has experienced fluctuations driven by macroeconomic factors and company-specific developments. The COVID-19 pandemic accelerated e-commerce growth, boosting the company’s revenues and stock price significantly. However, recent economic instability in key markets like Argentina and Brazil has introduced some volatility.

Despite these challenges, MELI’s strong financial performance, driven by its diversified revenue streams, has helped it maintain a competitive position. The company’s Q3 2024 earnings report showcased a year-over-year revenue increase of 30%, underlining its ability to navigate economic headwinds effectively.

Competitive Position in the Stock Market

MELI stock is often compared to global e-commerce giants like Amazon and Alibaba. However, its dominance in Latin America, coupled with its fintech arm Mercado Pago, sets it apart. Analysts frequently highlight its unique position as a leader in a rapidly growing market with untapped potential.

Investors also view MELI stock as a gateway to participating in the burgeoning digital economy of Latin America. This perception has kept its valuation high relative to other regional players, despite temporary market corrections.

Conclusion

MELI stock’s market performance reflects both its successes and the challenges of operating in emerging markets. While external factors may introduce short-term volatility, the company’s consistent innovation and market leadership provide a strong foundation for long-term growth. For investors seeking exposure to Latin America’s digital economy, MELI remains a top contender.

Revenue Streams Breakdown

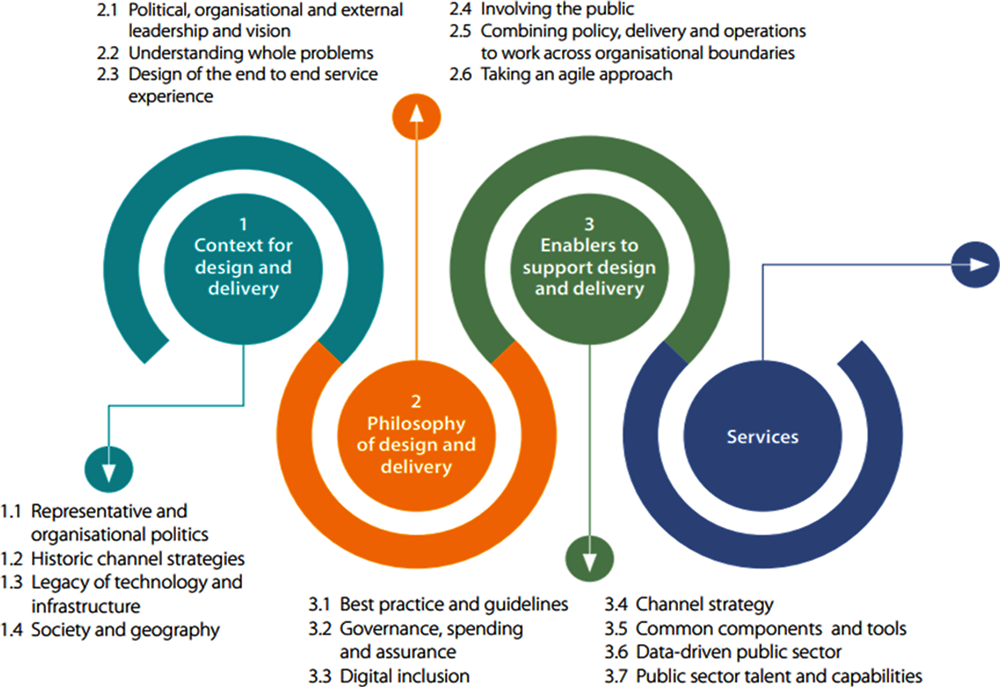

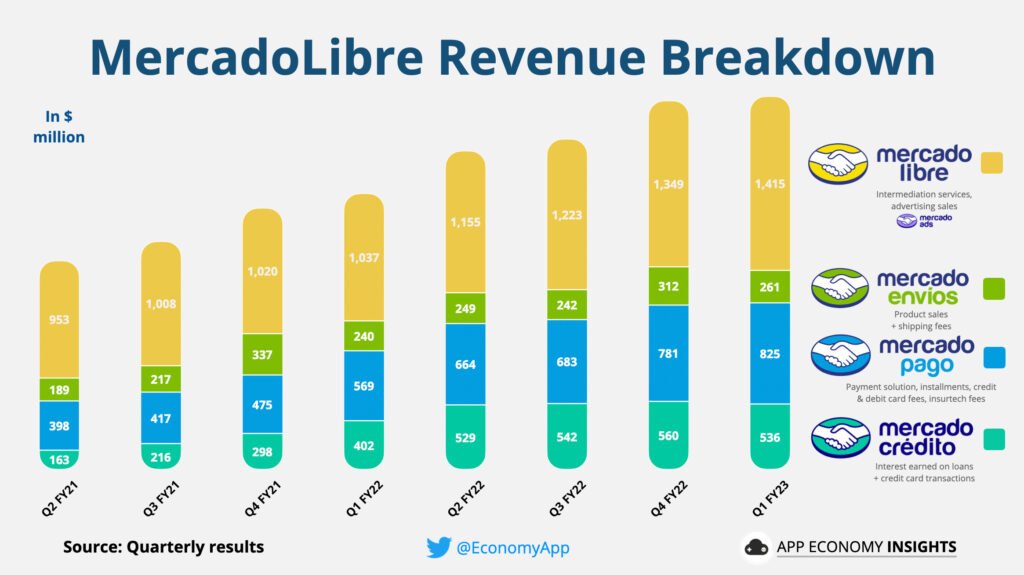

MercadoLibre (MELI) has developed a diverse range of revenue streams, making its stock highly attractive to investors. Understanding the breakdown of these revenue sources provides valuable insight into the company’s business model and its ability to sustain growth in the competitive e-commerce and fintech landscape.

Marketplace Revenue

The core of MercadoLibre’s business lies in its e-commerce marketplace. This segment generates revenue primarily through transaction fees charged to sellers. With millions of active users across Latin America, the platform has established itself as a trusted hub for buying and selling goods online.

- Key Highlight: In 2024, the marketplace accounted for approximately 60% of total revenue, showcasing its pivotal role in driving the company’s financial performance.

Image Placement: Pie chart showing the percentage contribution of marketplace revenue to total revenue.

Fintech Revenue: Mercado Pago

Mercado Pago, the company’s digital payment arm, is a significant contributor to MELI’s revenue. Initially designed to facilitate transactions on the marketplace, Mercado Pago has expanded into a standalone fintech solution, offering payment processing, credit lines, and even cryptocurrency trading.

- Fintech revenue grew by 45% year-over-year in 2024, driven by the increasing adoption of digital payments in Latin America.

Advertising Services

MercadoLibre’s advertising services provide another growing revenue stream. Sellers on the platform use sponsored listings to increase their visibility, which generates additional income for the company. With more businesses joining the platform, advertising revenue has experienced steady growth.

- This segment currently contributes 10% of total revenue, with significant potential for expansion as e-commerce adoption rises.

Logistics Revenue: Mercado Envíos

Mercado Envíos, the logistics and fulfillment arm of MercadoLibre, plays a crucial role in enhancing customer experience and retention. The service has expanded its reach, offering same-day and next-day delivery in key markets. While not as large as other revenue streams, it strengthens the ecosystem by ensuring seamless order fulfillment.

Other Revenue Streams

MercadoLibre also earns revenue through smaller but emerging channels, such as credit solutions, insurance services, and subscriptions. These initiatives not only diversify its income but also deepen customer engagement.

Conclusion

The diversified revenue streams of MELI stock are a testament to its robust and scalable business model. By integrating e-commerce, fintech, logistics, and advertising into a seamless ecosystem, MercadoLibre has positioned itself as a market leader in Latin America. Each segment plays a critical role in driving growth, making MELI stock a compelling choice for investors seeking a balanced mix of innovation and stability.

Geographical Influence

MercadoLibre (MELI) has built its dominance by strategically focusing on Latin America, one of the fastest-growing regions for e-commerce and digital payments. The geographical influence of MELI stock is a key factor in its performance and potential, as the company continues to strengthen its presence in key markets and expand into new territories.

Key Markets Driving Growth

- Brazil

As the largest economy in Latin America, Brazil is MercadoLibre’s most significant market, accounting for nearly 50% of its total revenue. The country’s rapid adoption of e-commerce and digital payment solutions has fueled MELI’s growth. Brazil is also home to Mercado Pago’s most extensive user base, further boosting the company’s fintech revenues.Image Placement: Map highlighting MercadoLibre’s market share in Brazil compared to competitors. - Argentina

Argentina, where MercadoLibre was founded, remains a vital market for the company. Despite economic volatility, the company has maintained strong growth here due to its established brand loyalty and market-leading position. Argentina contributes significantly to MELI’s logistics and marketplace operations. - Mexico

Mexico has emerged as a high-growth market for MELI stock. With increasing internet penetration and a large, young population, e-commerce adoption has surged. MercadoLibre has invested heavily in logistics infrastructure in Mexico, including fulfillment centers and last-mile delivery, to compete with global giants like Amazon.Image Placement: Bar chart comparing e-commerce growth rates in Brazil, Argentina, and Mexico.

Regional Opportunities

Latin America is still in the early stages of digital transformation, offering untapped potential for MercadoLibre. Countries like Colombia, Chile, and Peru are becoming increasingly significant as the company expands its footprint. These markets provide opportunities for MELI to replicate its success in Brazil, leveraging its established ecosystem of marketplace, fintech, and logistics services.

Challenges by Region

Operating across diverse countries brings unique challenges, including economic instability, regulatory hurdles, and competition. For instance:

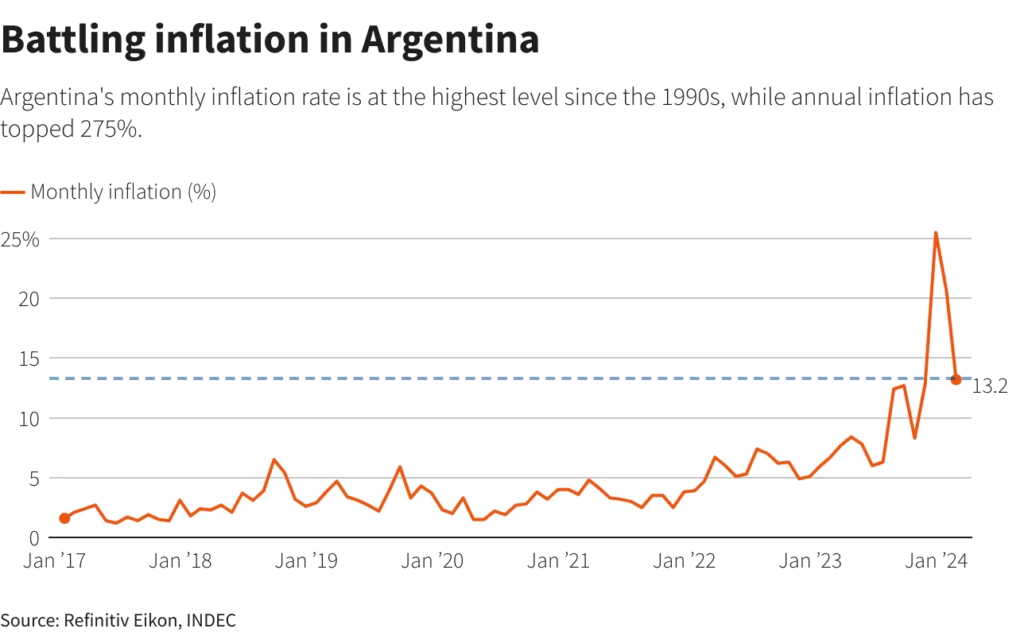

- Argentina’s inflation can impact consumer spending and operational costs.

- Brazil’s tax regulations pose complexity in scaling operations.

Despite these challenges, MELI’s localized strategies and deep understanding of regional markets have helped it maintain resilience.

Impact on MELI Stock Performance

The geographical diversification of MercadoLibre’s operations contributes to the stability of MELI stock. By reducing dependency on a single market, the company mitigates risks and captures opportunities across the Latin American region. This strategy has bolstered investor confidence and enhanced the stock’s long-term growth potential.

Conclusion

MercadoLibre’s geographical influence underpins its success and differentiates MELI stock from competitors. By dominating key markets like Brazil, Argentina, and Mexico while exploring untapped opportunities in emerging regions, the company continues to strengthen its position as a leader in Latin America’s digital economy.

Competitor Comparison

MercadoLibre (MELI) operates in a competitive e-commerce and fintech landscape, with rivals ranging from global giants to local players. Analyzing MELI’s competitors provides valuable insights into its strengths, challenges, and the factors that set it apart in the Latin American market. This comparison underscores why MELI stock remains a focal point for investors seeking growth in this region.

Key Global Competitors

- Amazon

Amazon is one of MercadoLibre’s primary competitors in Latin America. While Amazon has significant global influence, it has struggled to establish the same dominance in Latin America due to challenges in logistics and local market penetration.- Advantage for MELI: MercadoLibre’s deep regional understanding and established logistics network give it an edge over Amazon in key markets like Brazil and Argentina.

- Alibaba

Alibaba competes with MELI indirectly through cross-border trade. Its low-cost products appeal to budget-conscious consumers in Latin America. However, Alibaba lacks a strong local presence, which limits its ability to compete effectively in the region.- Advantage for MELI: Localized services like Mercado Pago and Mercado Envíos provide MELI with a comprehensive ecosystem, outmatching Alibaba’s offerings.

Regional Competitors

- B2W (Americanas)

B2W, a major Brazilian e-commerce player, poses direct competition to MercadoLibre in Brazil. With strong backing from local retail chains, B2W is a formidable competitor in terms of marketplace offerings.- Advantage for MELI: MercadoLibre’s fintech arm, Mercado Pago, adds a layer of service that B2W cannot fully match.

- Magazine Luiza (Magalu)

Magalu is another Brazilian e-commerce leader with a focus on digital transformation and omnichannel strategies. It has a significant retail footprint, combining online and offline sales.- Advantage for MELI: MercadoLibre’s regional reach and superior logistics infrastructure give it broader scalability.

- Local Startups

Numerous startups are entering the e-commerce and fintech sectors in Latin America. While these startups may focus on niche markets, they often lack the scale and resources to compete directly with MercadoLibre.

Competitive Advantages of MELI

- Integrated Ecosystem:

MELI’s marketplace, fintech (Mercado Pago), logistics (Mercado Envíos), and advertising services work together to create a seamless user experience. This sets it apart from competitors offering standalone services. - First-Mover Advantage:

Being an early entrant in Latin America’s e-commerce market has allowed MELI to establish a strong brand presence and loyal customer base. - Localized Operations:

MELI’s deep understanding of local markets and commitment to building region-specific solutions give it a competitive edge over global players.

Impact on MELI Stock

MELI stock benefits from the company’s ability to outperform competitors in critical areas such as logistics, fintech, and customer engagement. Its dominant position in Latin America’s growing digital economy continues to attract investor confidence, reinforcing its status as a market leader.

Conclusion

While MercadoLibre faces strong competition from global and regional players, its integrated ecosystem, first-mover advantage, and localized strategies have solidified its leadership in Latin America. These factors make MELI stock a compelling choice for investors looking to capitalize on the region’s e-commerce and fintech growth.

Growth Potential

MercadoLibre (MELI) stock is widely regarded as a high-growth investment, driven by the company’s innovative strategies and the rapid adoption of digital services in Latin America. By analyzing key factors contributing to its growth potential, investors can better understand why MELI stock remains a strong contender in the e-commerce and fintech sectors.

Expanding E-commerce Market

Latin America’s e-commerce market is expected to grow significantly in the coming years, fueled by increasing internet penetration, smartphone usage, and a shift in consumer behavior.

- MercadoLibre’s Advantage: As a dominant player in the region, MercadoLibre is well-positioned to capture a substantial share of this growth. Its marketplace revenue continues to climb, supported by a growing seller base and improved logistics infrastructure.

Rising Demand for Digital Payments

Mercado Pago, the company’s fintech division, is another driver of MELI’s growth potential. With a population that has historically been underserved by traditional banks, Latin America represents a massive opportunity for digital payment solutions.

- Key Growth Area: Mercado Pago’s services, including mobile payments, credit, and cryptocurrency, are seeing robust adoption. This positions MELI as not just an e-commerce leader but also a fintech innovator.

Geographic Expansion

While MercadoLibre dominates key markets like Brazil, Argentina, and Mexico, the company is gradually expanding its presence in emerging markets such as Colombia, Chile, and Peru. These regions present untapped opportunities for growth, particularly in areas like digital payments and logistics.

- Growth Strategy: MELI is investing heavily in local fulfillment centers and last-mile delivery solutions to enhance its competitive edge in these regions.

Technological Innovations

MercadoLibre continues to invest in technology to streamline its operations and improve user experience. Initiatives like AI-powered product recommendations, advanced logistics algorithms, and secure payment systems contribute to higher customer retention and sales growth.

- Future Potential: These innovations not only strengthen MELI’s ecosystem but also make it more competitive against global giants like Amazon and Alibaba.

Government Support for Digital Transformation

Many Latin American governments are promoting digital transformation initiatives, such as improved internet infrastructure and e-commerce-friendly policies. These developments create a favorable environment for companies like MercadoLibre to thrive.

Challenges to Consider

While the growth potential for MELI stock is immense, it is not without challenges:

- Economic Volatility: Currency fluctuations and inflation in key markets could impact profitability.

- Competition: Global and regional players continue to vie for market share, requiring MercadoLibre to stay ahead through innovation and investment.

Conclusion

MercadoLibre’s growth potential is underpinned by its leadership in the e-commerce and fintech markets, its strategic investments in technology and logistics, and the untapped opportunities in emerging regions. These factors make MELI stock a compelling choice for investors seeking exposure to Latin America’s digital transformation.

Risks and Challenges

While MercadoLibre (MELI) has significant growth potential, investors must consider the risks and challenges that could impact its stock performance. Understanding these risks is essential for making informed investment decisions and evaluating the long-term viability of MELI stock.

Economic Instability in Latin America

A major risk for MercadoLibre is the economic instability in key markets, particularly Brazil and Argentina.

- Inflation and Currency Fluctuations: In countries like Argentina, high inflation and currency devaluation can erode consumer purchasing power and increase operational costs for MercadoLibre.

- Impact on MELI Stock: Economic crises in these regions can lead to short-term volatility in MELI stock, as consumer confidence and spending decrease.

Intense Competition

MercadoLibre faces competition from both local players and global giants like Amazon and Alibaba, which are increasingly investing in Latin America.

- Market Share Pressure: As these companies expand their reach, MELI could face market share erosion, especially in countries where it is not yet the dominant player.

- Competitive Advantage: MELI’s integrated ecosystem and localized services give it a competitive edge, but it must continue to innovate and invest in infrastructure to maintain its lead.

Regulatory and Tax Risks

MercadoLibre operates in multiple countries, each with its own regulatory environment. Tax laws, data privacy regulations, and e-commerce rules can vary significantly across the region.

- Changing Regulations: New taxes or stricter regulations could increase costs or limit operational flexibility, potentially impacting profitability.

- Impact on MELI Stock: Uncertainty in the regulatory environment can create volatility in MELI stock, particularly when changes occur unexpectedly or impact core business areas like fintech and e-commerce.

Logistics and Infrastructure Challenges

MercadoLibre’s growth relies heavily on its logistics network, including fulfillment centers, delivery infrastructure, and payment systems.

- Last-Mile Delivery Issues: In regions with less-developed infrastructure, last-mile delivery can be a logistical challenge, impacting customer satisfaction and profitability.

- Investment Needs: As MELI expands into new markets, it will need to invest significantly in improving and expanding its logistics infrastructure to meet increasing demand.

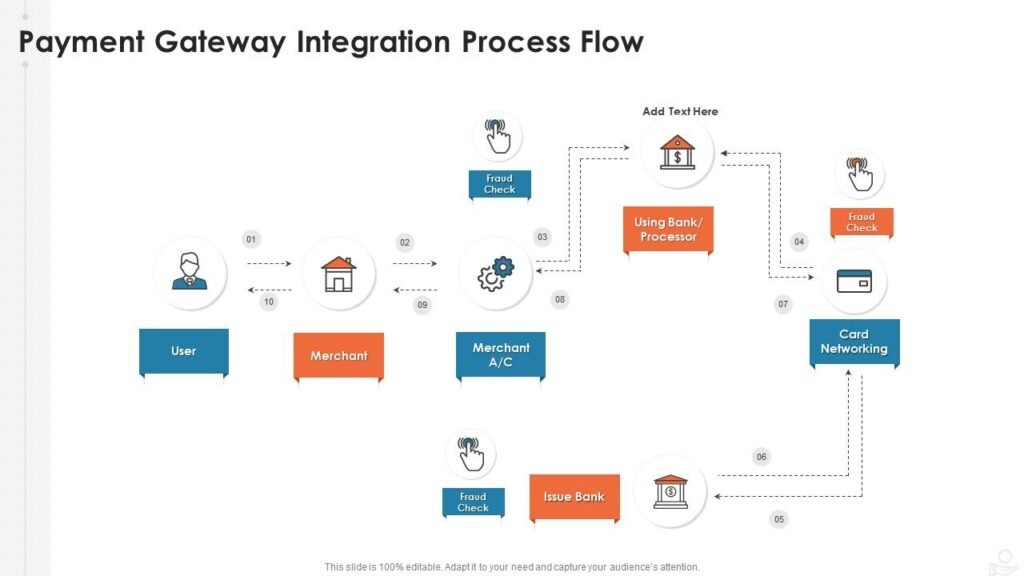

Cybersecurity and Fraud Risks

As a leading online marketplace and payment provider, MercadoLibre faces cybersecurity risks, including data breaches and fraud.

- Data Protection: With an increasing number of transactions taking place through Mercado Pago, protecting user data and securing transactions is a top priority.

- Fraud Prevention: MercadoLibre must continually enhance its security measures to maintain consumer trust and avoid potential regulatory scrutiny over data privacy concerns.

Global Economic Factors

While MercadoLibre’s core markets are in Latin America, global economic factors, such as inflation, interest rates, and trade tensions, can impact its performance.

- Global Recession Impact: A downturn in the global economy could lead to reduced demand for goods and services in Latin America, affecting MELI’s revenue streams.

Conclusion

While MercadoLibre (MELI) offers substantial growth opportunities, investors must weigh the risks and challenges that could impact its long-term performance. Economic instability, competition, regulatory hurdles, and infrastructure needs are key factors to consider when evaluating MELI stock. By understanding these risks, investors can make more informed decisions about whether MELI stock fits their investment strategy.

Financial Health Metrics

Understanding MercadoLibre’s (MELI) financial health is critical for assessing the long-term stability and growth potential of the stock. By examining key financial metrics, investors can gain insights into the company’s profitability, liquidity, and overall financial performance. Below, we break down the most important financial health metrics for MercadoLibre.

Revenue Growth

One of the primary indicators of MercadoLibre’s financial health is its revenue growth. Over the past several years, the company has consistently reported strong growth in both its marketplace and fintech segments.

- Recent Growth Figures: In Q3 2024, MercadoLibre reported a year-over-year revenue increase of 30%, driven by strong demand in e-commerce and digital payments across Latin America.

- Growth Drivers: The expansion of Mercado Pago, as well as increased consumer spending in Brazil and Mexico, are major contributors to this growth.

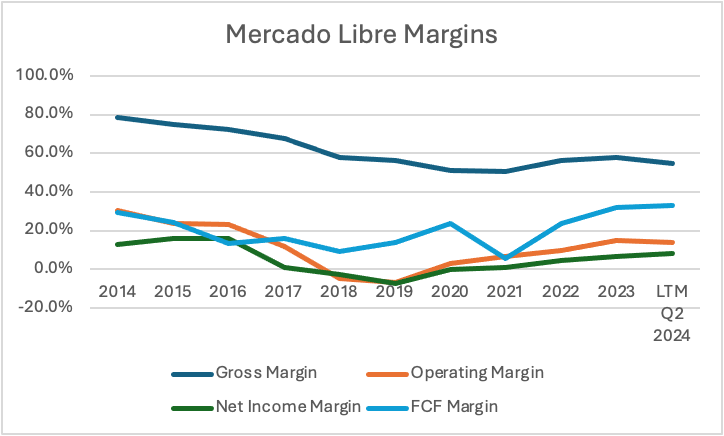

Profitability Metrics

MercadoLibre has managed to balance growth with profitability, a key metric for assessing its long-term sustainability. Key profitability metrics include:

- Gross Margin: MercadoLibre has maintained a healthy gross margin of around 50%, which indicates strong profitability from its marketplace and fintech operations. This is a positive indicator for MELI stock, showing the company can generate profit from its core services.

- Operating Profit (EBITDA): MercadoLibre’s EBITDA margin has steadily improved, reaching 15% in 2024. This reflects the company’s ability to efficiently manage costs while scaling operations.

Liquidity and Cash Flow

Liquidity and cash flow are essential in evaluating MercadoLibre’s ability to meet its short-term obligations and fund growth initiatives.

- Cash Flow from Operations: In 2024, MercadoLibre reported a strong cash flow from operations of $700 million, reflecting solid operational efficiency.

- Cash and Equivalents: With a robust balance of $1.5 billion in cash reserves, MercadoLibre is well-positioned to weather economic volatility and invest in future growth opportunities.

Debt Levels and Leverage

MercadoLibre has kept its debt levels relatively manageable, maintaining a debt-to-equity ratio of 0.4, indicating that the company is not overly reliant on debt for financing its operations.

- Impact on MELI Stock: A low debt-to-equity ratio provides financial flexibility and reduces the risk of financial distress, which is favorable for long-term investors.

Return on Investment (ROI)

Another critical metric for assessing MercadoLibre’s financial health is its return on investment (ROI). MELI has consistently demonstrated strong returns on capital, indicating efficient use of investor capital.

- ROI Metrics: In 2024, MercadoLibre reported a return on equity (ROE) of 18%, which is well above the industry average for e-commerce companies. This high ROE demonstrates the company’s ability to generate substantial returns from its equity investments.

Stock Performance and Valuation

MercadoLibre’s stock performance is a key reflection of its financial health and investor sentiment.

- Stock Price Growth: MELI stock has grown by 120% over the past 12 months, outperforming many of its competitors in the region.

- Valuation Metrics: MercadoLibre currently trades at a price-to-earnings (P/E) ratio of 45x, indicating that investors are willing to pay a premium for the stock due to its growth potential. However, this also suggests that MELI stock may be overvalued, warranting careful consideration for potential investors.

Conclusion

MercadoLibre’s financial health metrics reflect a strong, growing company with a solid profitability track record, healthy cash flow, and manageable debt levels. The company’s consistent revenue growth, efficient capital use, and strong stock performance position MELI as a promising long-term investment. However, the high valuation could suggest some risks for investors, and those looking to invest in MELI stock should carefully monitor its financial performance over time.

Investor Sentiment

Investor sentiment plays a crucial role in the performance of MercadoLibre (MELI) stock. It reflects how investors perceive the company’s future growth prospects, profitability, and overall financial health. Positive sentiment can drive up stock prices, while negative sentiment can lead to declines. In this section, we will examine the factors that influence investor sentiment toward MercadoLibre and how this sentiment impacts MELI stock.

Strong Demand for E-commerce and Fintech

One of the main drivers of positive investor sentiment for MercadoLibre is the rapid growth of e-commerce and digital payment solutions in Latin America.

- E-commerce Growth: As one of the largest online marketplaces in the region, MercadoLibre is positioned to benefit from the increasing adoption of online shopping, especially in countries like Brazil and Mexico.

- Fintech Expansion: Mercado Pago, MercadoLibre’s fintech arm, has seen robust growth as more consumers in Latin America turn to digital payment solutions, which has further bolstered investor confidence.

Market Leadership and Brand Recognition

MercadoLibre’s strong brand recognition and position as a market leader contribute significantly to positive investor sentiment.

- Dominant Position: MercadoLibre has a clear first-mover advantage in Latin American e-commerce, allowing it to capture a substantial portion of the market. This dominance is reassuring to investors, as it suggests long-term sustainability.

- Reputation for Innovation: MercadoLibre’s commitment to innovation, particularly in logistics and digital payments, enhances its reputation as a forward-thinking company, further boosting investor confidence.

Investor Confidence in Leadership

The leadership of MercadoLibre is another factor that positively influences investor sentiment.

- Experienced Management: Under the leadership of CEO Marcos Galperin and the company’s executive team, MercadoLibre has expanded its operations across Latin America and diversified its services, strengthening its competitive position.

- Strategic Investments: Investors are also confident in MercadoLibre’s strategy to reinvest profits into expanding logistics networks, enhancing technology, and entering new markets.

Risk Factors Affecting Sentiment

Despite positive sentiment, there are risk factors that can influence how investors perceive MercadoLibre’s future.

- Economic Instability: Political and economic instability in key markets like Argentina, Brazil, and Venezuela can negatively affect investor sentiment, especially when it leads to lower consumer spending or regulatory challenges.

- Currency Fluctuations: MercadoLibre is exposed to currency fluctuations in its key markets, which could impact revenue and profitability. Sudden changes in currency values can create volatility in investor sentiment.

Analysts’ Outlook and Recommendations

Analysts’ opinions play a significant role in shaping investor sentiment. The majority of analysts currently have a buy rating on MELI stock, reflecting strong confidence in the company’s future growth.

- Target Price: Analysts have set a target price of $1,700 for MercadoLibre stock, based on its dominant position in Latin America and growth in its fintech division.

- Short-Term Volatility: While analysts remain optimistic about the long-term outlook, some caution that MELI stock may experience short-term volatility due to global market conditions and regional risks.

Institutional Investor Interest

Institutional investors, such as mutual funds, pension funds, and hedge funds, also significantly impact investor sentiment. MercadoLibre’s consistent growth and leadership in Latin American markets have made it a popular choice among institutional investors.

- Investment Inflows: Over the past year, MELI has seen substantial inflows from institutional investors, further boosting market confidence.

Social Media and Retail Investor Sentiment

In today’s digital age, social media and online platforms can greatly influence investor sentiment. MercadoLibre has a strong presence on social media, where both retail and institutional investors discuss the company’s prospects.

- Retail Investor Interest: Retail investors have become increasingly interested in MELI stock, especially as Latin American markets continue to grow. Positive discussions on platforms like Twitter and Reddit contribute to higher visibility and optimism surrounding the stock.

Conclusion

Investor sentiment around MercadoLibre (MELI) is largely positive, driven by the company’s dominant position in e-commerce and fintech, strong leadership, and growth potential in Latin America. While there are risks, particularly related to economic volatility in key markets, overall sentiment remains favorable, supported by strong market leadership and investor confidence. As MercadoLibre continues to innovate and expand, investor sentiment is likely to remain a key factor driving the stock’s performance.

Stock Valuation

Understanding the stock valuation of MercadoLibre (MELI) is crucial for determining whether the stock is fairly priced, undervalued, or overvalued. A stock’s valuation is determined by various metrics that help investors gauge its market worth relative to its earnings, growth potential, and industry trends. In this section, we will explore the key valuation metrics for MELI stock and what they imply for potential investors.

Price-to-Earnings (P/E) Ratio

The price-to-earnings (P/E) ratio is one of the most commonly used metrics for evaluating stock valuation. It compares the stock price to the company’s earnings per share (EPS) over a specified period.

- MELI’s P/E Ratio: As of 2024, MercadoLibre’s P/E ratio stands at 45x, which is higher than the industry average for e-commerce and fintech companies.

- Interpretation: A P/E ratio of 45x suggests that investors are willing to pay a premium for MercadoLibre’s stock, reflecting expectations of strong future growth. However, this high valuation also indicates that the stock may be overpriced, especially if growth slows down.

Price-to-Sales (P/S) Ratio

The price-to-sales (P/S) ratio measures a company’s stock price relative to its total revenue. It provides insight into how much investors are willing to pay for every dollar of revenue the company generates.

- MELI’s P/S Ratio: MercadoLibre’s P/S ratio is 8.5x, which is above the industry median but still reasonable when considering the company’s growth trajectory.

- Interpretation: A higher P/S ratio can be justified if the company is growing rapidly and has strong revenue potential. MercadoLibre’s dominant position in Latin America’s e-commerce and fintech sectors supports this higher valuation.

Price-to-Book (P/B) Ratio

The price-to-book (P/B) ratio compares the stock’s market value to its book value (assets minus liabilities). A high P/B ratio may indicate that investors are willing to pay a premium for the stock due to its growth potential or intangible assets like brand value.

- MELI’s P/B Ratio: MercadoLibre has a P/B ratio of 12x, which is relatively high compared to the average for the industry.

- Interpretation: This suggests that investors are valuing MercadoLibre not just for its tangible assets but also for its growth prospects, brand strength, and market dominance in Latin America.

Enterprise Value-to-EBITDA (EV/EBITDA)

The enterprise value-to-EBITDA (EV/EBITDA) ratio provides a more comprehensive measure of a company’s valuation by factoring in both its market capitalization and debt levels. It is particularly useful for comparing companies in the same industry.

- MELI’s EV/EBITDA Ratio: MercadoLibre’s EV/EBITDA ratio stands at 32x, indicating that investors are willing to pay 32 times the company’s earnings before interest, taxes, depreciation, and amortization.

- Interpretation: A higher EV/EBITDA ratio often suggests that the company is expected to grow rapidly. MercadoLibre’s strong position in Latin America and its expansion into fintech help justify this high valuation.

Discounted Cash Flow (DCF) Valuation

The discounted cash flow (DCF) method estimates the intrinsic value of a company based on the present value of its future cash flows.

- DCF Analysis for MELI: Using conservative growth estimates, a DCF analysis for MercadoLibre suggests an intrinsic value per share of approximately $1,600, which is slightly lower than the current market price.

- Interpretation: The DCF valuation implies that MELI stock might be slightly overvalued at current levels, though strong future growth could justify the premium.

Sustainability and ESG Initiatives

As global interest in sustainability and Environmental, Social, and Governance (ESG) practices continues to rise, investors are increasingly looking at how companies align with these values. MercadoLibre (MELI), the leading e-commerce and fintech company in Latin America, has been taking steps to incorporate sustainability and ESG principles into its operations. In this section, we will explore MercadoLibre’s commitment to sustainability and how its ESG initiatives can impact the company’s long-term growth and investor sentiment.

Environmental Initiatives

MercadoLibre has made substantial progress in minimizing its environmental impact, with a focus on reducing carbon emissions, energy consumption, and waste.

- Carbon Neutrality Goals: MercadoLibre has set ambitious goals to achieve carbon neutrality by 2030. This includes reducing emissions across its supply chain, optimizing its delivery fleet, and investing in energy-efficient technologies.

- Sustainable Packaging: The company has also worked on reducing packaging waste by promoting eco-friendly packaging solutions. This includes encouraging sellers to use recyclable materials and offering incentives for sustainable practices.

Social Responsibility and Community Impact

MercadoLibre’s social responsibility efforts focus on improving the lives of people in the communities where it operates, particularly by fostering financial inclusion and supporting education.

- Financial Inclusion: Through its fintech arm, Mercado Pago, MercadoLibre is helping unbanked and underbanked populations in Latin America access digital payment services and financial products. This is an essential part of MercadoLibre’s commitment to economic empowerment in the region.

- Educational Initiatives: MercadoLibre is also investing in education through various partnerships and programs aimed at improving digital literacy. By offering online courses and training, the company helps to bridge the digital divide in underserved communities.

Governance and Ethical Business Practices

MercadoLibre places a strong emphasis on governance and ethical business practices, ensuring transparency and accountability in its operations.

- Corporate Governance: The company adheres to high standards of corporate governance, with a focus on transparency in its financial reporting and business practices. This includes ensuring that the board of directors is diverse and that executive compensation is aligned with long-term shareholder interests.

- Data Privacy and Security: MercadoLibre is committed to protecting customer data and ensuring that its platforms adhere to strict data privacy and security standards. With increasing concerns over cybersecurity, MercadoLibre invests heavily in maintaining the integrity and safety of user data.

Sustainability in Logistics and Supply Chain

MercadoLibre is also working to make its logistics and supply chain more sustainable, which is a key area for a company operating on the scale of MercadoLibre.

- Green Delivery Solutions: MercadoLibre has been exploring electric vehicles and alternative fuels for its delivery fleet to reduce carbon emissions associated with transportation. The company is investing in sustainable delivery methods to further its goal of reducing the environmental impact of its operations.

- Sustainable Warehousing: MercadoLibre is focused on making its warehouses more energy-efficient, with plans to incorporate solar energy and other renewable sources into its facilities. By optimizing energy use and waste management, the company aims to make its logistics operations more sustainable.

Investor Sentiment Toward ESG Initiatives

The market’s increasing focus on ESG factors means that companies like MercadoLibre that adopt strong sustainability practices are likely to gain favor with socially-conscious investors.

- Positive ESG Impact: Investors are increasingly considering ESG ratings and sustainability initiatives when making investment decisions. MercadoLibre’s dedication to improving its ESG profile could contribute to long-term value creation, attracting institutional investors who prioritize responsible investing.

- Transparency and Reporting: MercadoLibre’s efforts to be transparent about its ESG initiatives and report on progress through annual sustainability reports also help to build investor trust and confidence in the company’s future.

Economic and Industry Trends

Understanding the broader economic and industry trends is essential for evaluating the long-term potential of MercadoLibre (MELI) stock. These trends provide valuable insights into the forces that shape the company’s market performance, profitability, and growth. In this section, we will explore key economic and industry trends affecting MercadoLibre and how they impact its stock valuation and future prospects.

E-commerce Growth in Latin America

One of the most significant trends driving MercadoLibre’s growth is the continued expansion of e-commerce across Latin America.

- Rising Internet Penetration: Internet access is steadily increasing across the region, with more consumers shopping online than ever before. According to Statista, internet penetration in Latin America is expected to reach 80% by 2025, creating a larger customer base for MercadoLibre’s platform.

- Consumer Behavior Shifts: Consumers in Latin America are increasingly favoring online shopping for convenience, product variety, and competitive pricing. MercadoLibre, as the dominant e-commerce player in the region, stands to benefit significantly from these changing consumer behaviors.

Expansion of Fintech Services

Another key trend that is benefiting MercadoLibre is the growth of digital payments and fintech services in Latin America, which are expanding rapidly due to the need for convenient, secure, and accessible financial services.

- Mercado Pago’s Growth: MercadoLibre’s fintech arm, Mercado Pago, has seen explosive growth, with over 40 million active users in 2024. Mercado Pago’s services include mobile payments, money transfers, and credit offerings, which are increasingly in demand.

- Banking the Unbanked: A significant portion of the Latin American population remains unbanked or underbanked. Mercado Pago’s mobile wallet and payment services are helping to fill this gap, offering financial inclusion to millions of people.

Economic Volatility in Latin America

Despite the positive trends, there are several economic challenges that investors must consider when evaluating MercadoLibre. Latin America is known for its economic volatility, which can impact the performance of companies like MercadoLibre.

- Inflation and Currency Depreciation: Countries like Argentina and Brazil are grappling with high inflation rates and volatile currencies. This can lead to fluctuations in the purchasing power of consumers, affecting MercadoLibre’s sales and profitability.

- Political Instability: Political instability in key markets can also create uncertainty for investors. Changes in government policies, particularly related to taxes, trade, or regulations, can directly affect MercadoLibre’s operations.

The Rise of Digital Logistics and Delivery Services

As e-commerce continues to grow, so does the demand for efficient logistics and delivery services.

- Mercado Libre’s Logistics Network: MercadoLibre has made significant investments in its logistics infrastructure, including warehouses, fulfillment centers, and delivery networks. This enables the company to offer faster delivery times, which is a key competitive advantage in the e-commerce industry.

- Industry Trends: The logistics and last-mile delivery market is expected to grow significantly in Latin America, driven by the increasing demand for faster, more reliable e-commerce services. Companies like MercadoLibre are positioning themselves to capitalize on this trend by enhancing their logistics capabilities.

Digital Advertising and Data Monetization

Another trend driving MercadoLibre’s growth is the increasing importance of digital advertising and the monetization of consumer data.

- Advertising Revenue Growth: MercadoLibre’s advertising segment has seen significant growth, as businesses in Latin America increasingly turn to digital platforms to reach consumers. MercadoLibre offers targeted advertising opportunities to sellers and brands, contributing to revenue diversification.

- Data and Personalization: As MercadoLibre gathers more consumer data through its e-commerce and fintech platforms, it can leverage this data for more personalized advertising and recommendations, creating a more lucrative revenue stream.

Increasing Competition from Global and Regional Players

As the e-commerce and fintech industries grow, competition is intensifying.

- Global Giants: MercadoLibre faces competition from global players like Amazon and Alibaba, which are expanding their presence in Latin America. While MercadoLibre remains the dominant regional player, global competition could impact its market share.

- Regional Competitors: Companies like B2W and Magazine Luiza are also emerging as strong competitors in the Latin American e-commerce space. These players are investing heavily in logistics, digital payments, and marketing to capture more market share.

Conclusion

meli stock growth prospects are strongly tied to several key economic and industry trends, including the rapid expansion of e-commerce and fintech in Latin America, increasing demand for digital payment solutions, and the company’s investments in logistics infrastructure. However, economic volatility, competition, and political uncertainty in key markets could pose risks to its long-term performance.

Investors in MELI stock should closely monitor these trends, as they will play a significant role in shaping the company’s future growth and financial performance. Understanding these trends provides a comprehensive view of the forces driving meli stock price and overall market potential

Future Outlook for MELI Stock

The future outlook for MercadoLibre MELI stock is shaped by several factors, including its growth trajectory in e-commerce and fintech, the macroeconomic environment in Latin America, and its competitive position in the market. As the leading e-commerce and fintech platform in the region, meli stockis well-positioned for continued growth, but investors must also consider the risks that could impact its future performance. In this section, we will explore the key factors that could influence the future of MELI stock and what investors can expect in the coming years.

Continued E-commerce Growth in Latin America

The e-commerce sector in Latin America is expected to continue expanding in the coming years, driven by increasing internet penetration, changing consumer habits, and growing smartphone adoption.

- Market Expansion: MercadoLibre is well-positioned to capture a significant share of this expanding market. With its extensive logistics network, robust digital payment infrastructure, and strong brand recognition, meli stock is likely to see further growth in both Brazil and Mexico, which are the largest e-commerce markets in the region.

- Forecasted Growth: According to Statista, Latin American e-commerce sales are expected to grow by 15-20% annually over the next five years, and MercadoLibre is poised to benefit from this trend, given its dominant market position.

Expansion of Mercado Pago

MercadoLibre’s fintech arm, Mercado Pago, has become one of the most important growth drivers for the company.

- Financial Inclusion in Latin America: Mercado Pago has the opportunity to further penetrate the Latin American market, especially among the unbanked population. As digital payments continue to rise, Mercado Pago’s services are expected to expand, further diversifying meli stock revenue streams.

- Revenue Potential: In 2024, Mercado Pago accounted for 35% of meli stock total revenue, and this percentage is expected to grow significantly as the adoption of digital wallets and mobile payment solutions increases.

Competitive Position and Market Leadership

meli stock strong market position and leadership in Latin American e-commerce and fintech will continue to support its growth outlook.

- Barriers to Entry: meli stock benefits from its first-mover advantage in the region, as well as its extensive logistics network and large-scale user base. These factors create high barriers to entry for new competitors and help the company maintain its dominance in the region.

- Rising Competition: While meli stock faces increasing competition from both global players like Amazon and Alibaba and regional competitors like B2W and Magazine Luiza, its comprehensive platform that includes e-commerce, fintech, and logistics remains a significant competitive advantage.

Risks from Economic and Political Instability

While meli stock is well-positioned for growth, investors must be mindful of the risks that could negatively impact the company’s future performance.

- Currency Depreciation: meli stock operates in multiple Latin American countries with volatile currencies, particularly in Argentina and Brazil. Currency devaluations could affect profitability, especially in markets where the company has significant exposure.

- Political Instability: Political instability in key markets could also affect consumer spending, disrupt operations, or lead to unfavorable regulatory changes. These risks could cause short-term fluctuations in MELI stock, though meli stock diversified operations help mitigate some of these challenges.

Technological Advancements and Innovation

meli stock ongoing investments in technology, particularly in areas like artificial intelligence (AI), machine learning (ML), and data analytics, are expected to support long-term growth.

- Logistics and Delivery Efficiency: meli stockis enhancing its logistics capabilities with AI-powered algorithms that optimize delivery routes, reduce costs, and improve customer satisfaction. These innovations are expected to drive operational efficiency, leading to improved margins.

- Personalized Shopping Experience: The company is also investing in personalized shopping experiences by leveraging consumer data to offer targeted recommendations, which can increase customer retention and sales.

Stock Valuation and Market Sentiment

Despite the strong growth prospects, meli stock stock valuation remains relatively high, which could limit short-term upside potential for investors.

- Premium Valuation: As discussed earlier, MELI stock trades at premium valuation multiples, such as a P/E ratio of 45x. While this reflects strong growth expectations, it also suggests that the stock may face downward pressure if growth slows or if external factors, such as macroeconomic instability, impact the company.

- Analyst Predictions: Analysts are generally optimistic about MELI stock’s long-term outlook, with most holding a buy rating. However, they caution that short-term volatility could impact the stock, especially in the face of macroeconomic challenges or increased competition.

Conclusion

The future outlook for MercadoLibre MELI stock remains positive, driven by continued e-commerce growth in Latin America, the expansion of Mercado Pago’s fintech services, and the company’s strong competitive position. However, investors must also consider the risks posed by economic volatility, political instability, and intense competition. As meli stock continues to innovate and expand, its long-term growth potential looks promising, though short-term fluctuations in stock performance are possible due to market conditions.

Investors should keep an eye on these factors, as they will play a crucial role in determining the stock’s future performance. Given meli stockmarket leadership and ongoing investments in technology, the company is well-positioned for continued growth in the years to come.

Let me know if you’d like further analysis or adjustments to this section!

Get 40% off 3 Months or a Free Trial meli stock